22+ Mortgage amount borrow

Income Taxes vs Payroll Taxes. Up to 72 Months.

Basic Zero Based Budget Worksheet Template Download Printable Budget Worksheet Budgeting Worksheets Free Budgeting Worksheets

Payment examples can be obtained by clicking the calculate payments button above and do not include taxes or insurance premiums.

. If you take out a 20000 personal loan you may wind up paying the lender a total of almost 23000 over the life of the loan. Weve had to make some assumptions to calculate the approximate amount you could borrow. Modified Tenure Payment Plan.

Used Cars With Model Years. Minimum loan amount is 25000 Maximum loan amount is 100000 4 Maximum LTV loan to value. August 22 2022.

For example if your new refinance loan is 200000 then your new UFMIP amount is 3500 200000 x 0. Once you know the market value of your home subtract the amount you still owe on your mortgage and any other debts secured by your home. Just enter your income debts and some other information to get NerdWallets recommendation for how big a mortgage.

The above rates are separate from Federal Insurance Contributions Act taxes which fund Social Security and MedicareEmployees and employers typically pay half of the 124 Social Security 145 Medicare benefit each for a total of 153. And margin 300 stated on your loan NOTE. A way to receive reverse mortgage proceeds in which the borrower gets access to a line of credit as well as equal monthly payments for as long as he or she lives in.

There is no payment required so the balance grows and as the balance grows so does the amount of interest you accrue. VA jumbo assumes a loan amount of 548251 with no down payment. Due to amendments to the Overseas Investment Act 2005 which came into effect on 22 October 2018 all non-resident purchasers must complete a Residential Land.

The result is your home. Mortgage Term of More Than 15 Years Base Loan Amount LTV MIP bps Duration Less than or equal to 625500 9000 80 11 years 9000 but 9500 80 Mortgage term 9500 85 Mortgage term 9000 but 9500 100 Mortgage term 9500 105 Mortgage term Mortgage Term of Less than or Equal to 15 Years Base Loan Amount LTV MIP bps. That extra 3000 is.

By taking money out of your 401k to get a mortgage loan you can seriously reduce the amount in your savings when youre ready to retire. A purchase reverse mortgage supplies the total amount of the loan for which you are eligible at the closing and you. VA rates assume a loan amount of 250000 and no down payment.

A mortgage for a new home with an accepted contract. Flexible Down Payment Options Pay as little as 5 down for conventional loans or 3 down for eligible applicants. Here are 3 Reverse Mortgage Examples in 2022 March 22.

You accrue interest on the money you borrow. At the end of the mortgage term the original loan will still need to be paid back. Private Mortgage Insurance - PMI.

The maximum amount you can borrow varies depending on the lender but its usually between 75 and 90 of the value of the home. Even though there are programs to help lower down payments most people will need more than. With a capital and interest option you pay off the loan as well as the interest on it.

Simple Online Application Compare mortgage options and apply in minutes with our streamlined quote and. SOFR was 070 as of 61522. Your MIP refund amount see above section for how to calculate Next subtract your MIP refund amount from your new mortgage loans UFMIP amount.

Exclusions and TCs Apply. A fixed-rate mortgage means your monthly principal and interest payments will stay the same for the life of your loan. How do you borrow from your life insurance.

The mortgage should be fully paid off by the end of the full mortgage term. This amount is the total UFMIP you owe on your new refinance loan. Now lets say.

You will be hard-pressed to find a home for less than 500000. Private Mortgage Insurance PMI is a special type of insurance policy provided by private insurers to protect a lender against loss if a borrower defaults. A home equity loan is a second loan thats separate from your mortgage and allows you to borrow against the equity in your home.

Conventional and Jumbo Loans Find the right mortgage for your needs with fixed and adjustable-rate options for both conventional and jumbo loans. Multiply your homes value 350000 by. For example say your home is worth 350000 your mortgage balance is 200000 and your lender will allow you to borrow up to 85 of your homes value.

In a 200000 home this is 40000. The amount youll pay each year to borrow the money expressed as a percentage. Interest is the price you pay to borrow money.

A longer-term loan allows for lower monthly payments. As with a cash-out refi the amount you can borrow. The amount you can borrow may differ from lender to lender so it can be worth boosting your borrower.

If your rate changed on 61522 it would adjust to 370 070 SOFR index 300 margin. A standard mortgage requires a 20 down payment. Use How Much Can I Borrow calculator to know your borrowing capacity to pay for your mortgage personal or home loan based on your income expenditure.

Toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z fillF9C32D. Conventional jumbo loans assume a loan amount of 548251 and a 40 down payment. No small amount of money to save.

Your situation including your income and expenses doesnt change for the life of the loan. With an interest only mortgage you are not actually paying off any of the loan. Find out how much you can afford to borrow with NerdWallets mortgage calculator.

Subtract your mortgage balance. Learn the steps here. Say you have 30000 in your 401k at age 30.

Aussiewide Financial Services Home Facebook

25 Letter Of Explanation Templates For Mortgage And Derogatory Credit Word Best Collections

201 Catchy Mortgage Company Slogans And Taglines Business Growth Strategies Growth Strategy Business Growth

![]()

Being A Treasurer 18 Pros And Cons

Articles By Tag Five Star Real Estate Five Star Real Estate Lakeshore Fivestar Lakeshore Blog

Image Result For Candy Poster For Best Friend Birthday Birthday Candy Posters Birthday Gifts For Best Friend Candy Poster

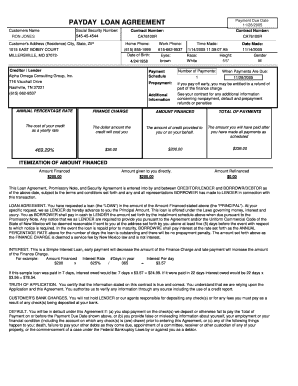

22 Free Editable Simple Loan Agreement Templates In Ms Word Doc Pdffiller

2

1 Guide For Conv Va Jumbo Home Loans Top Rated Local Buildbuyrefi Home Loan Experts 1 Construction Renovation Cash Out Purchase Loan Experts Buildbuyrefi Com

22 Printable Budget Worksheets Simple Budget Worksheet Printable Budget Worksheet Budgeting Worksheets

328q5jzc Io6xm

22 Free Editable Simple Loan Agreement Templates In Ms Word Doc Pdffiller

22 Ways To Use A Heloc First Financial Bank

2

1 Manufactured Home Loan Calculator How Much Can You Afford Manufactured Nationwide Home Loans 1 Manufactured Home Loan Lender In All 50 States

201 Catchy Mortgage Company Slogans And Taglines Business Growth Strategies Growth Strategy Business Growth

Sample Monthly Budget Template Business Budgeting Monthly Budget Monthly Budget Template